TF 2.0 GAN MLP for 100x100 financial correlation matrices

TF 2.0 GAN MLP for 100x100 financial correlation matrices

Give it some time for the animation below (heavy gif) to start (~30s):

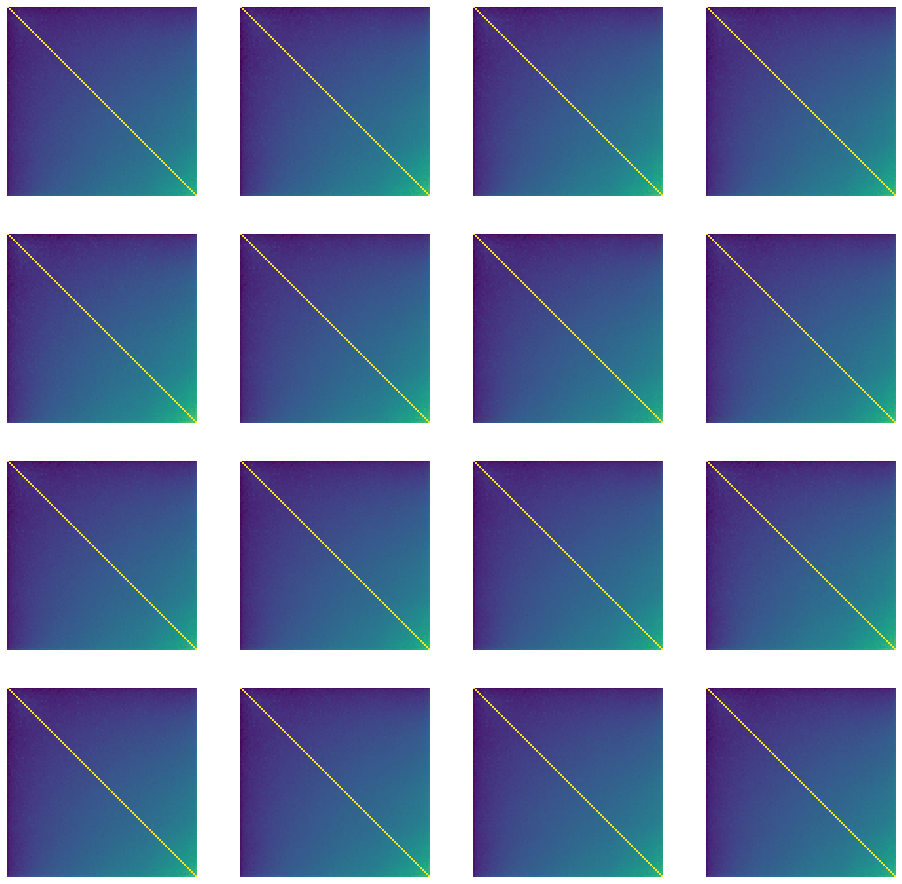

A few correlation matrices generated by the GAN, evolving during the iterative training process. From random noise to some structured matrix.

A few correlation matrices generated by the GAN, evolving during the iterative training process. From random noise to some structured matrix.

TL;DR This is an attempt toward a GAN for generating realistic financial correlation matrices. We are not there yet: Stylized facts (as described in this previous blog) are not verified.

For this blog, we will use TensorFlow 2.0, and play around with this DCGAN tutorial.

import tensorflow as tf

tf.__version__

'2.0.0-rc1'

%matplotlib inline

import os

import time

import glob

import imageio

import matplotlib.pyplot as plt

import pandas as pd

import numpy as np

import fastcluster

import networkx as nx

from scipy.cluster import hierarchy

import PIL

from tensorflow.keras import layers

from IPython import display

Because of the huge number of equivalent matrices (cf. this previous blog on permutation invariance in the context of correlation matrices), we re-order the correlation matrices using the following:

def canonical_repr(corr):

permutation = corr.sum(axis=1).argsort()

prows = corr[permutation, :]

perm = prows[:, permutation]

return perm

We will generate using the GAN only the upper triangular matrix, that is n * (n - 1) /2 coefficients. We are enforcing diag = 1 and the symmetry post-generation of the upper triangular.

n = 100

a, b = np.triu_indices(n, k=1)

corrs = []

for r, d, files in os.walk('sorted_corrs/'):

for file in files:

if 'corr_emp_{}d_batch_'.format(n) in file:

flat_corr = pd.read_hdf('sorted_corrs/{}'.format(file))

corr = np.ones((n, n))

corr[a, b] = flat_corr

corr[b, a] = flat_corr

canon_repr = canonical_repr(corr)

corrs.append(canon_repr[a, b])

corrs = (np

.array(corrs)

.reshape(len(corrs), int(n * (n - 1) / 2))

.astype('float32'))

corrs.shape

(9196, 4950)

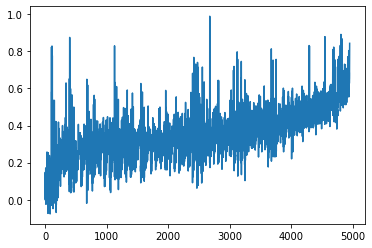

idx = 0

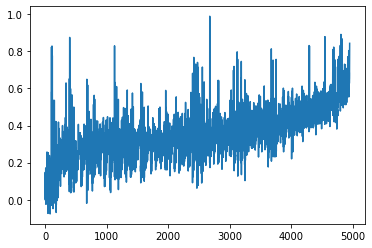

plt.plot(corrs[idx, :])

plt.show()

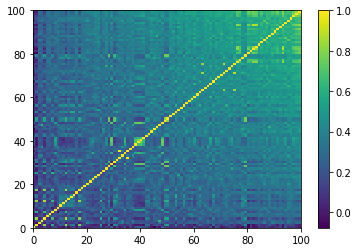

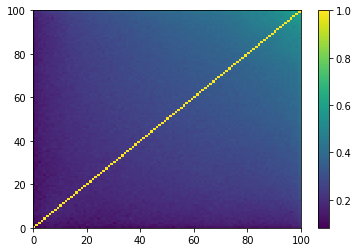

c = np.ones((n, n))

c[a, b] = corrs[idx, :]

c[b, a] = corrs[idx, :]

plt.pcolormesh(c)

plt.colorbar()

plt.show()

The n * (n - 1) / 2 = 4950 coefficients. These coefficients are real empirical pairwise correlations estimated from 100 time series of S&P 500 stock returns.

Note that this representation is the one obtained after re-ordering using the *canonical_repr* function.

The equivalent correlation matrix.

Note that this representation is the one obtained after re-ordering using the *canonical_repr* function.

Below, an implementation of the GAN in TF 2.0 with the Keras API.

BUFFER_SIZE = corrs.shape[0]

BATCH_SIZE = 256

# Batch and shuffle the data

train_dataset = (tf

.data.Dataset.from_tensor_slices(corrs)

.shuffle(BUFFER_SIZE)

.batch(BATCH_SIZE))

def make_generator_model():

model = tf.keras.Sequential()

model.add(layers.Dense(512, use_bias=False, input_shape=(100,)))

model.add(layers.BatchNormalization())

model.add(layers.LeakyReLU())

model.add(layers.Dense(1024, use_bias=False))

model.add(layers.BatchNormalization())

model.add(layers.LeakyReLU())

model.add(layers.Dense(2048, use_bias=False))

model.add(layers.BatchNormalization())

model.add(layers.LeakyReLU())

model.add(layers.Dense(int(n * (n - 1) / 2),

use_bias=False,

activation='tanh'))

return model

generator = make_generator_model()

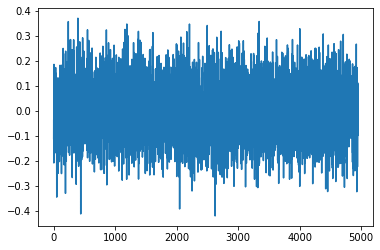

noise = tf.random.normal([1, 100])

generated_image = generator(noise, training=False)

plt.plot(generated_image[0, :])

plt.show()

Before any training of the generator: noise in, noise out.

def make_discriminator_model():

model = tf.keras.Sequential()

model.add(layers.Dense(1024, input_shape=[int(n * (n - 1) / 2)]))

model.add(layers.LeakyReLU())

model.add(layers.Dropout(0.3))

model.add(layers.Dense(512))

model.add(layers.LeakyReLU())

model.add(layers.Dropout(0.3))

model.add(layers.Dense(128))

model.add(layers.LeakyReLU())

model.add(layers.Dropout(0.3))

model.add(layers.Dense(64))

model.add(layers.LeakyReLU())

model.add(layers.Dropout(0.3))

model.add(layers.Flatten())

model.add(layers.Dense(1))

return model

discriminator = make_discriminator_model()

decision = discriminator(generated_image)

print(decision)

tf.Tensor([[0.0345522]], shape=(1, 1), dtype=float32)

# This method returns a helper function to compute cross entropy loss

cross_entropy = tf.keras.losses.BinaryCrossentropy(from_logits=True)

def discriminator_loss(real_output, fake_output):

real_loss = cross_entropy(tf.ones_like(real_output),

real_output)

fake_loss = cross_entropy(tf.zeros_like(fake_output),

fake_output)

total_loss = real_loss + fake_loss

return total_loss

def generator_loss(fake_output):

return cross_entropy(tf.ones_like(fake_output),

fake_output)

generator_optimizer = tf.keras.optimizers.Adam(1e-4)

discriminator_optimizer = tf.keras.optimizers.Adam(1e-4)

EPOCHS = 10000

noise_dim = 100

num_examples_to_generate = 16

# We will reuse this seed overtime (so it's easier)

# to visualize progress in the animated GIF)

seed = tf.random.normal([num_examples_to_generate, noise_dim])

# Notice the use of `tf.function`

# This annotation causes the function to be "compiled".

@tf.function

def train_step(images):

noise = tf.random.normal([BATCH_SIZE, noise_dim])

with tf.GradientTape() as gen_tape, tf.GradientTape() as disc_tape:

generated_images = generator(noise, training=True)

real_output = discriminator(images, training=True)

fake_output = discriminator(generated_images, training=True)

gen_loss = generator_loss(fake_output)

disc_loss = discriminator_loss(real_output, fake_output)

gradients_of_generator = gen_tape.gradient(

gen_loss, generator.trainable_variables)

gradients_of_discriminator = disc_tape.gradient(

disc_loss, discriminator.trainable_variables)

generator_optimizer.apply_gradients(

zip(gradients_of_generator, generator.trainable_variables))

discriminator_optimizer.apply_gradients(

zip(gradients_of_discriminator, discriminator.trainable_variables))

def train(dataset, epochs):

for epoch in range(epochs):

start = time.time()

for image_batch in dataset:

train_step(image_batch)

# Produce images for the GIF as we go

display.clear_output(wait=True)

generate_and_save_images(generator,

epoch + 1,

seed)

print ('Time for epoch {} is {} sec'.format(

epoch + 1, time.time() - start))

# Generate after the final epoch

display.clear_output(wait=True)

generate_and_save_images(generator,

epochs,

seed)

def generate_and_save_images(model, epoch, test_input):

# Notice `training` is set to False.

# This is so all layers run in inference mode (batchnorm).

predictions = model(test_input, training=False)

fig = plt.figure(figsize=(16, 16))

for i in range(predictions.shape[0]):

prediction = predictions[i, :]

corr = np.ones((n, n))

corr[a, b] = prediction

corr[b, a] = prediction

plt.subplot(4, 4, i + 1)

plt.imshow(corr)

plt.axis('off')

plt.savefig('v3_image_at_epoch_{:04d}.png'.format(epoch))

plt.show()

%%time

train(train_dataset, EPOCHS)

Time for epoch 10000 is 11.296852111816406 sec

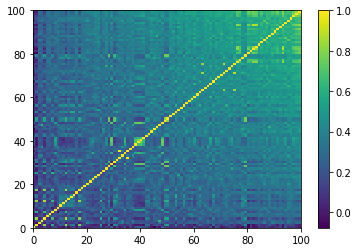

We generate one correlation matrix from the GAN (top the flatten representation, bottom the square matrix representation):

noise = tf.random.normal([1, 100])

generated_image = generator(noise, training=False)

plt.plot(generated_image[0, :])

plt.show()

c = np.ones((n, n))

c[a, b] = generated_image[0, :]

c[b, a] = generated_image[0, :]

plt.pcolormesh(c)

plt.colorbar()

plt.show()

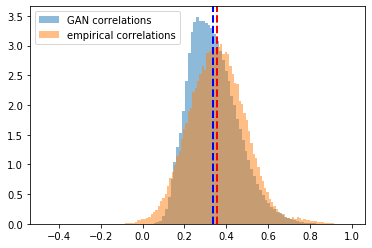

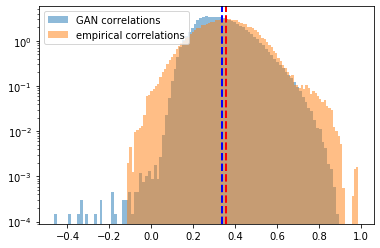

(Left) Correlation coefficients generated by the GAN; (Right) Empirical correlation coefficients estimated from stocks' returns.

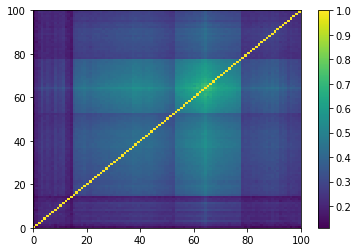

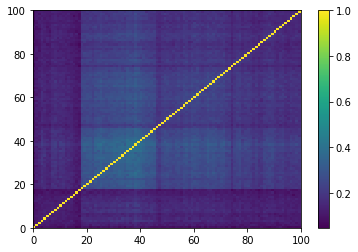

(Left) Correlation matrix generated by the GAN; (Right) Empirical correlation matrix estimated from stocks' returns.

Remark. The correlations generated seem too smooth with respect to the real data. To explore further the discrepancy between real and generated data, let’s look at the stylized properties of financial correlations below.

Let’s first generate, using the GAN, nb_samples = 100 correlation matrices. We will compare with another sample of 100 empirical correlation matrices estimated from real historical returns.

nb_samples = 100

generated_correls = []

for i in range(nb_samples):

noise = tf.random.normal([1, 100])

generated_image = generator(noise, training=False)

correls = np.array(generated_image[0, :])

generated_correls.extend(list(correls))

empirical_correls = []

for i in range(len(corrs[:min(nb_samples, len(corrs)), :])):

empirical = corrs[i, :]

empirical_correls.extend(list(empirical))

len(generated_correls), len(empirical_correls)

(495000, 495000)

Let’s look at the distribution of these correlation coefficients:

plt.hist(generated_correls, bins=100, alpha=0.5,

density=True, label='GAN correlations')

plt.hist(empirical_correls, bins=100, alpha=0.5,

density=True, label='empirical correlations')

plt.axvline(x=np.mean(generated_correls),

color='b', linestyle='dashed', linewidth=2)

plt.axvline(x=np.mean(empirical_correls),

color='r', linestyle='dashed', linewidth=2)

plt.legend()

plt.show()

plt.hist(generated_correls, bins=100, alpha=0.5,

density=True, log=True, label='GAN correlations')

plt.hist(empirical_correls, bins=100, alpha=0.5,

density=True, log=True, label='empirical correlations')

plt.axvline(x=np.mean(generated_correls),

color='b', linestyle='dashed', linewidth=2)

plt.axvline(x=np.mean(empirical_correls),

color='r', linestyle='dashed', linewidth=2)

plt.legend()

plt.show()

First, we notice that the mean of the two distributions is quite close (at around 0.35). The GAN has effectively learnt the distribution mean! However, the GAN fails at learning the right tail (a few coefficients are very high, close to 0.98), and fails to capture the non-existence of a left tail (correlations between stocks are usually not negative, and when they are, small in absolute value).

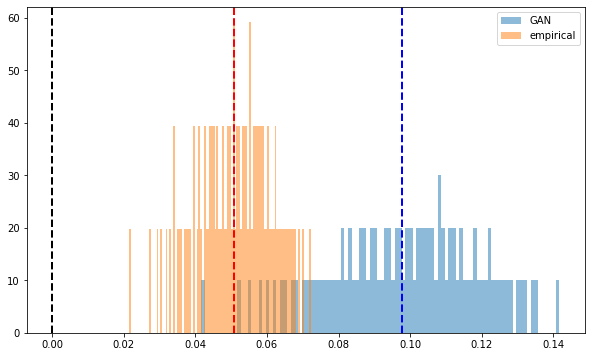

Then, let’s look at the distribution of their eigenvalues:

nb_samples = 100

generated_corr_mats = []

for i in range(nb_samples):

noise = tf.random.normal([1, 100])

generated_image = generator(noise, training=False)

correls = np.array(generated_image[0, :])

corr_mat = np.ones((n, n))

corr_mat[a, b] = correls

corr_mat[b, a] = correls

generated_corr_mats.append(corr_mat)

empirical_corr_mats = []

for i in range(len(corrs[:min(nb_samples, len(corrs)), :])):

empirical = corrs[i, :]

corr_mat = np.ones((n, n))

corr_mat[a, b] = empirical

corr_mat[b, a] = empirical

empirical_corr_mats.append(corr_mat)

def compute_eigenvals(correls):

eigenvalues = []

for corr in correls:

eigenvals, eigenvecs = np.linalg.eig(corr)

eigenvalues.append(sorted(eigenvals, reverse=True))

return eigenvalues

sample_mean_empirical_eigenvals = np.mean(

compute_eigenvals(empirical_corr_mats), axis=0)

sample_mean_gan_eigenvals = np.mean(

compute_eigenvals(generated_corr_mats), axis=0)

plt.figure(figsize=(10, 6))

plt.hist(sample_mean_gan_eigenvals, bins=n,

density=True, alpha=0.5, label='GAN')

plt.hist(sample_mean_empirical_eigenvals, bins=n,

density=True, alpha=0.5, label='empirical')

plt.legend()

plt.show()

Both have a very large first eigenvalue (capturing the market mode / the base correlation), but unlike the empirical case, the GAN-generated matrices don’t have a couple of large eigenvalues far apart the bulk of eigenvalues. Usually, these large eigenvalues correspond to the main factors (drivers of returns), that is for stocks from the same economic region, the industrial sectors. It seems that the GAN-generated matrices exhibit only one large eigenvalue outside the bulk, aside from the “market” eigenvalue. Put another way, these matrices should contain only one cluster.

Let’s verify that by re-ordering the correlation matrices using a hierarchical clustering algorithm later.

Concerning the Perron-Frobenius property (first eigenvector has positive entries):

def compute_pf_vec(correls):

pf_vectors = []

for corr in correls:

eigenvals, eigenvecs = np.linalg.eig(corr)

pf_vector = eigenvecs[:, np.argmax(eigenvals)]

if len(pf_vector[pf_vector < 0]) > len(pf_vector[pf_vector > 0]):

pf_vector = -pf_vector

pf_vectors.append(pf_vector)

return pf_vectors

mean_empirical_pf = np.mean(

compute_pf_vec(empirical_corr_mats), axis=0)

mean_gan_pf = np.mean(

compute_pf_vec(generated_corr_mats), axis=0)

plt.figure(figsize=(10, 6))

plt.hist(mean_gan_pf, bins=n, density=True,

alpha=0.5, label='GAN')

plt.hist(mean_empirical_pf, bins=n, density=True,

alpha=0.5, label='empirical')

plt.axvline(x=0,

color='k', linestyle='dashed', linewidth=2)

plt.axvline(x=np.mean(mean_gan_pf),

color='b', linestyle='dashed', linewidth=2)

plt.axvline(x=np.mean(mean_empirical_pf),

color='r', linestyle='dashed', linewidth=2)

plt.legend()

plt.show()

Perron-Frobenius property (first eigenvector has positive entries) is verified, but the distributions don't closely match.

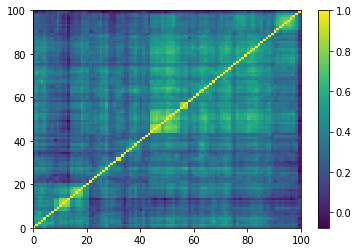

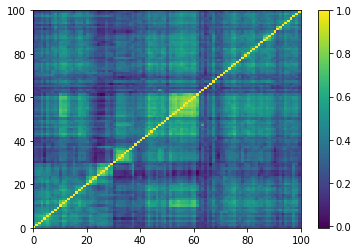

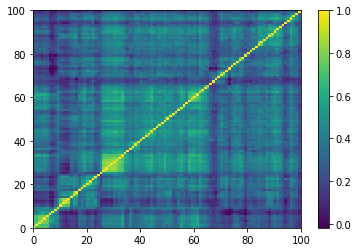

Concerning the hierarchical clustering property:

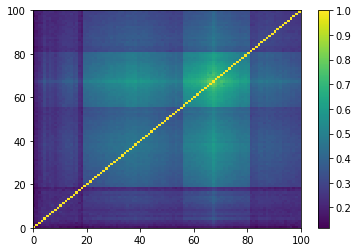

for idx, corr in enumerate(empirical_corr_mats):

dist = 1 - corr

Z = fastcluster.linkage(dist[a, b], method='ward')

permutation = hierarchy.leaves_list(

hierarchy.optimal_leaf_ordering(Z, dist[a, b]))

prows = corr[permutation, :]

ordered_corr = prows[:, permutation]

plt.pcolormesh(ordered_corr)

plt.colorbar()

plt.show()

if idx > 5:

break

Empirical correlation matrices do verify this property, and the clusters correspond to industrial sectors.

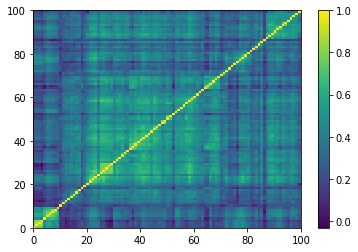

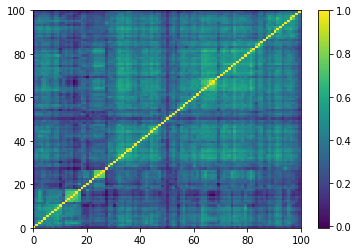

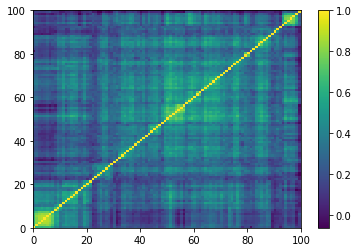

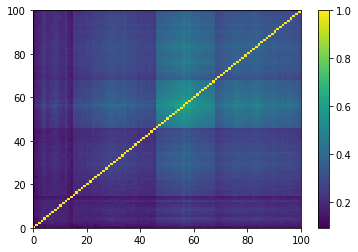

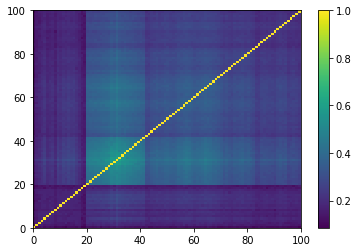

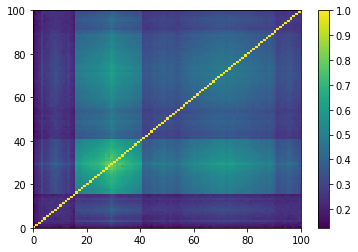

for idx, corr in enumerate(generated_corr_mats):

dist = 1 - corr

Z = fastcluster.linkage(dist[a, b], method='ward')

permutation = hierarchy.leaves_list(

hierarchy.optimal_leaf_ordering(Z, dist[a, b]))

prows = corr[permutation, :]

ordered_corr = prows[:, permutation]

plt.pcolormesh(ordered_corr)

plt.colorbar()

plt.show()

if idx > 5:

break

As expected by the study of eigenvalues, the GAN-generated matrices do not really contain clusters, but maybe a broad one that is not very distant (uncorrelated) to the rest. This should mean that a few “artificial” stocks are strongly connected to most of the other stocks. And, we can read also from these matrices, that many of the “artificial” stocks are not connected to others but to this central stocks.

We can verify this claim with a quick network study.

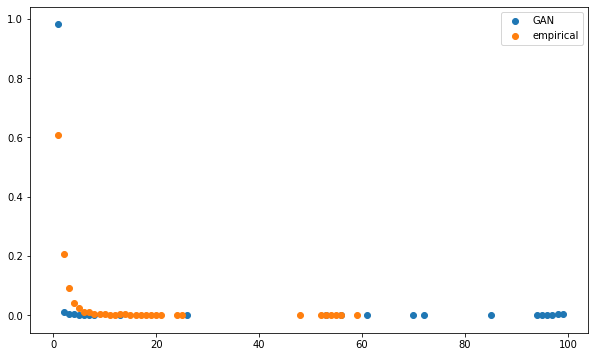

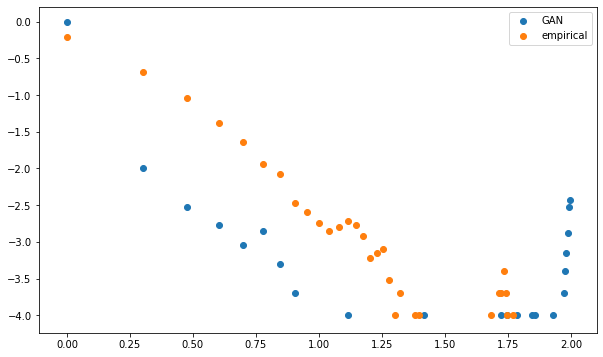

Let’s compute the minimum spanning tree (MST) (cf. this review pointing to a vast literature of networks applications in financial markets). From this MST, let’s extract an important summary statistics: the distribution of the vertices’ degrees (k(i) = the number of vertices connected to the given vertex i; d(k) = the normalised number of vertices having degree k).

For empirical correlation matrices, this distribution should roughly follow a power law (linear relationship between degree and frequency in log-log plot).

def compute_degree_counts(correls):

all_counts = []

for corr in correls:

dist = (1 - corr) / 2

G = nx.from_numpy_matrix(dist)

mst = nx.minimum_spanning_tree(G)

degrees = {i: 0 for i in range(len(corr))}

for edge in mst.edges:

degrees[edge[0]] += 1

degrees[edge[1]] += 1

degrees = pd.Series(degrees).sort_values(ascending=False)

cur_counts = degrees.value_counts()

counts = np.zeros(len(corr))

for i in range(len(corr)):

if i in cur_counts:

counts[i] = cur_counts[i]

all_counts.append(counts / (len(corr) - 1))

return all_counts

mean_gan_counts = np.mean(

compute_degree_counts(generated_corr_mats), axis=0)

mean_gan_counts = (pd

.Series(mean_gan_counts)

.replace(0, np.nan))

mean_empirical_counts = np.mean(

compute_degree_counts(empirical_corr_mats), axis=0)

mean_empirical_counts = (pd

.Series(mean_empirical_counts)

.replace(0, np.nan))

plt.figure(figsize=(10, 6))

plt.scatter(mean_gan_counts.index,

mean_gan_counts,

label='GAN')

plt.scatter(mean_empirical_counts.index,

mean_empirical_counts,

label='empirical')

plt.legend()

plt.show()

plt.figure(figsize=(10, 6))

plt.scatter(np.log10(mean_gan_counts.index),

np.log10(mean_gan_counts),

label='GAN')

plt.scatter(np.log10(mean_empirical_counts.index),

np.log10(mean_empirical_counts),

label='empirical')

plt.legend()

plt.show()

Again, the distributions do not closely match.

It confirms what we hypothesised with the visual representation: A few nodes are strongly connected to the rest, and many nodes have few connections. In the case of GAN-generated matrices/networks, the number of leaves (degree one, i.e. only one connection) is abnormally high; the ‘too low’ number of ‘average’ degrees (the linear log-log relationship) hints at a lack of hierarchical structure (communities). This power-law-like feature is characteristic of complex systems, and has been described in the context of financial correlations many times since 1999, for a variety of asset classes.

Conclusion: Still some work to do. A vanilla GAN was not able to capture precisely the empirical distribution of these financial correlation matrices. What’s next? More training samples (only ~9000 in this experiment)? More epochs (10,000 here, but seems to have reached an equilibrium)? A different representation for the matrices? A more relevant architecture for the discriminator and/or generator?