Quick correlation study between BTC/USD and ETH/USD

import numpy as np

import scipy

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline

import seaborn as sns

import json

from datetime import timedelta

You can find and save yourself the data thanks to the cryptocompare API. Here, I select the pair BTC/USD (first link) and a daily aggregate (&aggregate=1&e=CCCAGG). I do the same for the ETH/USD pair.

- https://min-api.cryptocompare.com/data/histoday?fsym=BTC&tsym=USD&limit=600000000000&aggregate=1&e=CCCAGG

- https://min-api.cryptocompare.com/data/histoday?fsym=ETH&tsym=USD&limit=600000000000&aggregate=1&e=CCCAGG

data_BTC = []

with open('BTCUSD.json') as f:

for line in f:

data_BTC.append(json.loads(line))

data_ETH = []

with open('ETHUSD.json') as f:

for line in f:

data_ETH.append(json.loads(line))

histo_BTC = pd.DataFrame(data_BTC)

histo_ETH = pd.DataFrame(data_ETH)

histo_ETH['time'] = pd.to_datetime(histo_ETH['time'],unit='s')

histo_BTC['time'] = pd.to_datetime(histo_BTC['time'],unit='s')

histo_ETH.index = histo_ETH['time']

histo_BTC.index = histo_BTC['time']

histo_ETH.tail()

| close | high | low | open | time | volumefrom | volumeto | |

|---|---|---|---|---|---|---|---|

| time | |||||||

| 2017-08-18 | 292.62 | 306.52 | 287.17 | 300.30 | 2017-08-18 | 523133.90 | 1.553331e+08 |

| 2017-08-19 | 293.02 | 298.79 | 283.65 | 292.62 | 2017-08-19 | 458296.55 | 1.333319e+08 |

| 2017-08-20 | 298.20 | 298.78 | 288.48 | 293.02 | 2017-08-20 | 293661.68 | 8.621471e+07 |

| 2017-08-21 | 321.85 | 345.44 | 294.93 | 298.20 | 2017-08-21 | 1147950.71 | 3.713201e+08 |

| 2017-08-22 | 315.09 | 329.39 | 293.09 | 321.85 | 2017-08-22 | 728103.98 | 2.256794e+08 |

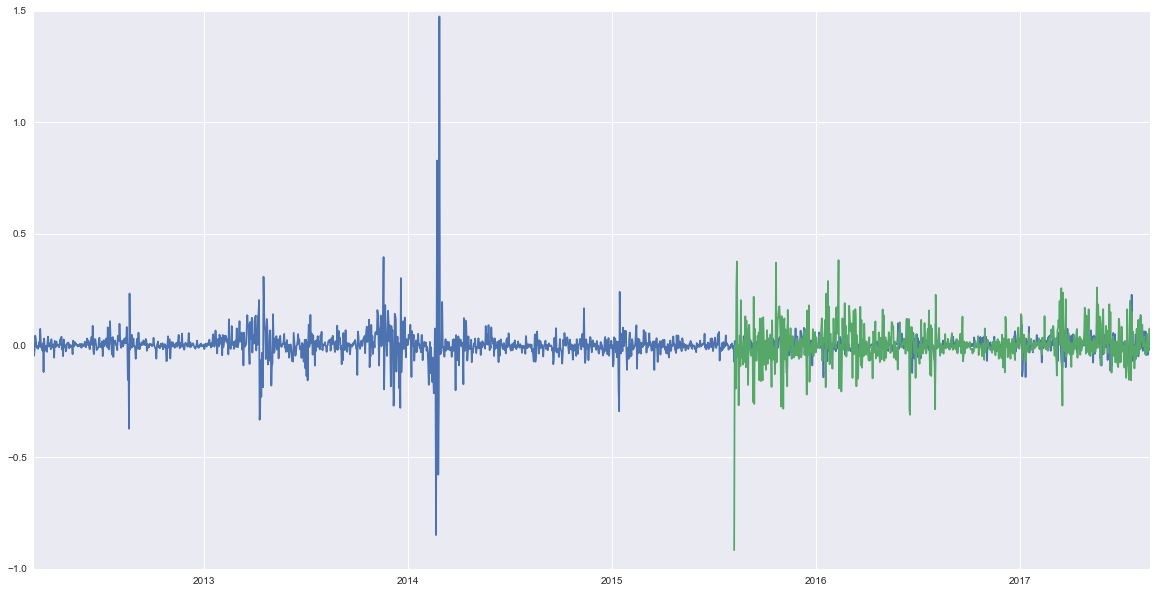

We compute the log returns from the prices:

returns_BTC = pd.DataFrame(np.diff(np.log(histo_BTC['close'].get_values()),axis=0))

returns_BTC.index = histo_BTC.index[1:]

returns_BTC.columns = ['returns']

returns_ETH = pd.DataFrame(np.diff(np.log(histo_ETH['close'].get_values()),axis=0))

returns_ETH.index = histo_ETH.index[1:]

returns_ETH.columns = ['returns']

plt.figure(figsize=(20,10))

plt.plot(returns_BTC)

plt.plot(returns_ETH)

plt.show()

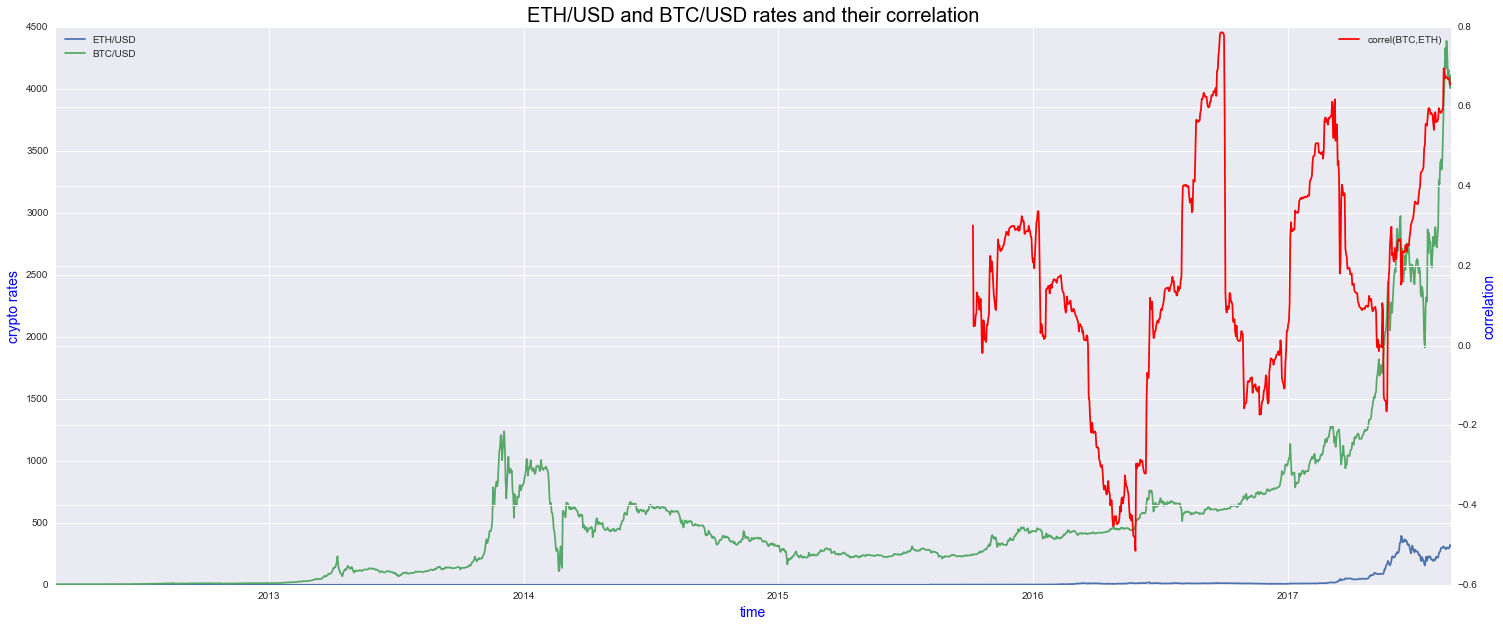

Then, we are going to compute the correlation on a rolling window of 60 consecutive days:

start_date = returns_BTC.index[0]

window_length = timedelta(days=60)

step_length = timedelta(days=1)

correls = []

start_window = start_date

while start_window + window_length <= histo_BTC.index[-1]:

end_window = start_window + window_length

window_returns_BTC = returns_BTC.loc[start_window:end_window]

window_returns_ETH = returns_ETH.loc[start_window:end_window]

correl = np.corrcoef(window_returns_BTC.values.flatten(),

window_returns_ETH.values.flatten(),

"spearman")[0,1]

correls.append(correl)

start_window += step_length

correl_df = pd.DataFrame(correls,index=returns_BTC.loc[start_date+window_length:].index,columns=['corr'])

plt.figure(figsize=(25,10))

ax = plt.gca()

ax2 = ax.twinx()

plt.axis('normal')

ax.plot(histo_ETH['close'])

ax.plot(histo_BTC['close'])

ax2.plot(correl_df,color='red')

ax.set_ylabel("crypto rates",fontsize=14,color='blue')

ax2.set_ylabel("correlation",fontsize=14,color='blue')

ax.grid(True)

plt.title("ETH/USD and BTC/USD rates and their correlation", fontsize=20,color='black')

ax.set_xlabel('time', fontsize=14, color='b')

ax.legend(['ETH/USD','BTC/USD'],loc='best')

ax2.legend(['correl(BTC,ETH)'],loc='upper right')

plt.show()

Here is the result:

Correlation between the two pairs is nearly at an all time high!