Basic DSPy RAG tutorial on DataGrapple blog posts

Basic DSPy RAG tutorial on DataGrapple blog posts

Disclaimer: The experiments detailed below are conducted independently and are not related to my current employment. They represent personal endeavors undertaken during my free time, primarily over weekends, with the aim of staying informed about the latest technological developments in the field of large language models. Nothing contained within this blog post should be construed as financial advice or an encouragement to engage in investment activities. The insights derived from the large language models (LLMs) are merely restatements of publicly available information sourced from DataGrapple blogs. These blogs primarily focus on describing the current state of the credit default swap (CDS) market and do not endeavor to predict future market movements.

This blog is more a note to self for experimenting further with DSPy (arXiv, GitHub) than a pedagogical or original intro to the framework.

It essentially follows this weaviate tutorial with small adaptations, notably removing the weaviate part of it, and replacing their retrieval module by a very basic local search in the embeddings.

I typically experiment against the jargon-heavy DataGrapple blog posts written by French portfolio managers.

It serves as a good ‘stress test’ for general-purpose NLP tools.

tl;dr The DSPy framework helps optimizing the prompts to obtain a better and more focused RAG.

We go automatically from the generic:

Answer questions based on the context.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Reasoning: Let's think step by step in order to ${produce the answer}. We ...

Answer: ${answer}

---

to:

Based on the provided business and financial contexts, provide detailed and specific answers that fully address the posed questions, drawing explicitly from the information given.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Reasoning: Let's think step by step in order to ${produce the answer}. We ...

Answer: ${answer}

---

which is a prompt tailored to our specific corpus.

DSPy RAG tutorial

First, install DSPy.

!pip install dspy-ai

Download a corpus of blogs against which we can look for precise answers.

!wget https://sp500-histo.s3.ap-southeast-1.amazonaws.com/blogs

import os

import pickle

import numpy as np

import pandas as pd

import dspy

from openai import OpenAI

from sklearn.metrics.pairwise import cosine_similarity

from tqdm import tqdm

os.environ['OPENAI_API_KEY'] = YOUR_OWN_OPENAI_API_KEY

client = OpenAI()

with open('blogs', 'rb') as f:

blogs = pickle.load(f)

len(blogs)

1238

blogs[0]

{'title': 'That Is A Big Deal',

'author': 'jbchevrel',

'date': '2019-04-12',

'link': 'https://www.datagrapple.com/Blog/Show/12272/that-is-a-big-deal.html',

'content': 'In a decently risk-on session (CDX IG -2.8 CDX HY -8.9 SPX @ 2,900), the CDS of Anadarko Petroleum Corp. (APC) outperformed the broader market, tightening by c65bp. Bonds are also 75-100bp tighter. That is because the oil giant Chevron Corp. (CVX) agreed to buy APC. The equity is valued $33B, which will be paid in stocks and cash (75/25: 0.3869 CVX shares and $16.25 in cash per APC share). That is a 39% premium therefore APC share soared towards the offer price (+23% on day). The transaction is expected to close in 2H19. CVX management doesn’t expect any regulatory issues. From a credit standpoint, CVX will assume $15B net debt from APC, making APC EV c$50B. CVX will issue 200M shares and pay $8B in cash. A very tight name, CVX widened 6bp to 33bp mid, making the APC/CVX spread tighten 71bp, from +70bp to -1bp! CVX is not really a story for credit. Indeed, CVX has c$9.4B cash on hand and past experience proves that it generates $8B+ FCF per year at $50-55/bbl crude (vs now WTI $64), so it looks unlikely that they will fund the non-share cash part (c$8B) with debt. And even in the unlikely event it would do that, the combined leverage would be somewhere around 1x. Adding to this point, the news that 1/ CVX expects to realize $2B synergies (proceeds partly used for debt reduction) 2/ CVX plans to sell $15-20bn of assets in 2020-2022 confirms that CVX credit is not in trouble anytime soon. Therefore the consensus expects CVX to keep its current rating (AA/Aa2), while APC will converge to CVX from its Ba1/BBB, although we don’t know if CVX will explicitly guarantee them. CVX aside, this news dragged all the US/Canada IG energy tighter, with Hess -22 Devon -15 Encana -13, partly because the market knew APC was a target and consolidation was expected. This acquisition shows the importance of size in this business, where the biggest and the most diversified players do well. '}

We can embed the blogs using the text-embedding-3-small model.

# client = OpenAI()

# embeddings = []

# for blog in tqdm(blogs):

# content = blog["content"]

# emb = client.embeddings.create(input=content, model="text-embedding-3-small").data[0].embedding

# embeddings.append([

# blog["title"],

# blog["author"],

# blog["date"],

# blog["link"],

# content,

# emb])

# df_embeddings = pd.DataFrame(

# embeddings,

# columns=["title", "author", "date", "link", "content", "embedding"]

# )

# df_embeddings.to_parquet("dg_blogs_with_openai_text-embedding-3-small_embeddings.parquet")

No need to recompute the embeddings again and again.

Let’s fetch them from s3.

!wget https://sp500-histo.s3.ap-southeast-1.amazonaws.com/dg_blogs_with_openai_text-embedding-3-small_embeddings.parquet

df_embeddings = pd.read_parquet("dg_blogs_with_openai_text-embedding-3-small_embeddings.parquet")

df_embeddings

| title | author | date | link | content | embedding | |

|---|---|---|---|---|---|---|

| 0 | That Is A Big Deal | jbchevrel | 2019-04-12 | https://www.datagrapple.com/Blog/Show/12272/th... | In a decently risk-on session (CDX IG -2.8 CDX... | [0.023862849920988083, -0.02890099585056305, 0... |

| 1 | Only Game In Town | jbchevrel | 2019-04-11 | https://www.datagrapple.com/Blog/Show/12271/on... | Today, the ECB pretty much dictated the price ... | [-0.0019143268000334501, 0.014265304431319237,... |

| 2 | Impairment Bites | jbchevrel | 2019-04-10 | https://www.datagrapple.com/Blog/Show/12270/im... | HEMA (short for 4 unpronounceable Dutch words)... | [-0.012396507896482944, 0.0550399050116539, 0.... |

| 3 | On The Red | jbchevrel | 2019-04-09 | https://www.datagrapple.com/Blog/Show/12269/on... | Today the 5y CDS of Crown Resorts Ltd (CWNAU) ... | [-0.031644079834222794, 0.004807306919246912, ... |

| 4 | Shipping Names Rocked | jbchevrel | 2019-04-08 | https://www.datagrapple.com/Blog/Show/12268/sh... | Today CMA CGM (CMACG) and Hapag-Lloyd AG (HPLG... | [0.01699497364461422, 0.003022479824721813, 0.... |

| ... | ... | ... | ... | ... | ... | ... |

| 1233 | PostNL (TNTNA) Delivers Good News | HCM | 2013-12-05 | https://www.datagrapple.com/Blog/Show/10/postn... | This is the first of our daily comment, a colu... | [0.0008119812700897455, 0.026372777298092842, ... |

| 1234 | High Trading Activity at the End of 2013 | HCM | 2013-12-04 | https://www.datagrapple.com/Blog/Show/2/high-t... | \r\nThe brown area chart tracks the evolution ... | [0.020368456840515137, 0.0014192602830007672, ... |

| 1235 | European Banks 2013: UCGIM vs STANLN | HCM | 2013-12-04 | https://www.datagrapple.com/Blog/Show/3/europe... | Grapple selection lets the user browse with a... | [-0.020505966618657112, 0.008376846089959145, ... |

| 1236 | Heinz (HNZ) – Too Hot for IG | HCM | 2013-12-04 | https://www.datagrapple.com/Blog/Show/5/heinz-... | This view gives a representation of the intens... | [-0.004270065575838089, -0.009213356301188469,... |

| 1237 | Monthly CDS Report | HCM | 2013-11-29 | https://www.datagrapple.com/Blog/Show/1/monthl... | Over the last month, the European CDS market h... | [-0.00585611816495657, 0.008636543527245522, 0... |

1238 rows × 6 columns

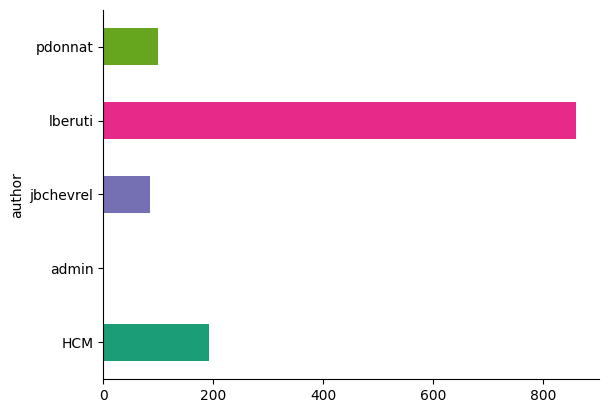

A bit useless, but suggested by Google Colab AI:

# generated by google colab ai

from matplotlib import pyplot as plt

import seaborn as sns

df_embeddings.groupby('author').size().plot(kind='barh', color=sns.palettes.mpl_palette('Dark2'))

plt.gca().spines[['top', 'right',]].set_visible(False)

embedding_matrix = np.stack(df_embeddings['embedding'].apply(np.array))

embedding_matrix.shape

(1238, 1536)

Basic retriever ‘module’

def embed_text(text):

response = client.embeddings.create(

input=text,

model="text-embedding-3-small")

return response.data[0].embedding

# the most naive and simple retriever

def retrieve(query, k=5):

query_embedding = embed_text(query)

scores = cosine_similarity(np.array(query_embedding).reshape(1, -1), embedding_matrix)

top_idx = scores.argsort()[0][::-1][:k]

return df_embeddings.iloc[top_idx]['content'].values.tolist()

retrieved_blogs = retrieve("What business did Conagra Brands Inc. spin off on November 9, 2016?")

retrieved_blogs

['CAG ( Conagra Brands Inc. ) was a 12BUSD revenues food US company based in Chicago. On November 9, 2016, the company completed the spin-off of Lamb Weston - essentially its frozen potato fries business (a 4BUSD revenue business). French fries and any sort of fried potatoes is a sound investment. Half of the debt of Conagra was pushed to the new company LW (( Lamb Weston Holdings Inc. ). From a BBB- company, the new Conagra is now BBB while Lamb Weston is a BB. According to last Friday’s ISDA determination committee, a CDS holder having 1MUSD protection on CAG is now having 500k on new CAG and 500k on LW. New CAG is indicated 20bps tighter while LW is 40bps wider. CAG is also a member of the investment grade credit indices in the US, the CDX.IG, in all series up to the latest the series 27. All credit indices members will also be split and will have 126 reference entities, CAG and LW being half weighted. This credit event is a source of large operations for credit derivatives trade processing in the next days.\n\nMeanwhile, the broader credit market went through a slow session with European investment grade risk being the weakest part of the investment spectrum.\n',

'Overnight 3G Capital Partners and Berkshire Hathaway have offered to merge Kraft Foods Group with HNZ (HJ Heinz Company) to create The Kraft Heinz Co. 3G and Berkshire will own 51% on the new company, while existing Kraft shareholders will get 49% and a $16.5 special dividend. Importantly for the CDS market, no new debt will be issued and the management announced that they are committed to maintaining an investment grade rating going forward. The operation is effectively removing the LBO risk which was overhanging on the food and beverage sector as 3G now appears committed (at least in the medium term). So entire complex traded better today, but the most spectacular move was seen in HNZ’s 5 year CDS which gapped 119bps to 64bps as investors expect it to be a dead box going forward.',

'Back in March, METFNL ( Metro AG ) announced that it would proceed with a demerger, in order to separate its food business (Food Co) from its Consumer Electronics business (CE Co). METFNL held a conference call on the 6th September to give further details regarding the operation. All the financial liabilities of the group including bonds will be assumed by Food Co. Pension liabilities will be allocated 40% to Food Co and 60% to CE Co. Lease obligations will be 60% and 40%, and cash balances 75% and 25% respectively. Even though METFNL’s management expects both companies to maintain an investment grade rating after the spin-off, there won’t be any capital increase. That means that Food Co, due to the high debt load, will have at best weak credit metrics for its rating category and will be left with very limited financial leeway. Moody’s is understood to effectively ask the management to do more if Food Co is to be eligible for IG rating. That is probably why METFNL which will reference Food Co going forward has underperformed its peers during the last week. \nMeanwhile, the broader credit market spent another day looking at US interest rates. It dithered all session, and was unable to decide whether to go wider or tighter. Credit indices traded in a range (328/335 for iTraxx Crossover and 69/72 for iTraxx Main) and eventually closed bang in the middle of it.\n',

'The failings of the food industry are in the spotlight again. This morning, ITV News and the Guardian have published a report that claims to have uncovered a series of safety breaches at the poultry plants of 2 Sisters Food Group (2SFG). The allegations involve tampering slaughter date of poultry being processed at sites that supply retailers including Tesco, Sainsbury’s, Marks & Spencer, Aldi and Lidl. The latters all said they would launch enquiries. Several of them decided to remove from their shelves products coming from the incriminated sites without further ado and have vowed to suspend their relationship with the firm until the investigation has concluded. 2SFG was founded in 1993 and now produces one third of all the poultry products consumed in the UK, and had revenues of £3.1Bln in 2016. Investors took the matter very seriously and parent company BOPRLN (Boparan Finance Plc) was under severe pressure as soon as the reports came out. Its 5-year risk premium jumped 169bps to 738bps. That is its widest level since it joined iTraxx Crossover 3 years ago.',

'In an environment which has been supportive for credit over the last 12 months, a few names have been trading wider, especially in the Consumer Non-Cyclical sector. Releveraging seems to be on the agenda of a few companies through different channels. For instance, on the one hand, DGX ( Quest Diagnostics Inc) experienced weak trading conditions and decided to support its share price through share buy-backs. On the other hand, Campbell Soup (Campbell Soup Company) has been the subject of takeover speculations. Out of the money options on the stock experienced unusually high volumes recently and 5 year protection has been pushed aggressively wider. LBO could be back in people’s mind if they think systemic risks are receding.']

The top blog post from the retriever is indeed the one we need to answer the question:

retrieved_blogs[0]

'CAG ( Conagra Brands Inc. ) was a 12BUSD revenues food US company based in Chicago. On November 9, 2016, the company completed the spin-off of Lamb Weston - essentially its frozen potato fries business (a 4BUSD revenue business). French fries and any sort of fried potatoes is a sound investment. Half of the debt of Conagra was pushed to the new company LW (( Lamb Weston Holdings Inc. ). From a BBB- company, the new Conagra is now BBB while Lamb Weston is a BB. According to last Friday’s ISDA determination committee, a CDS holder having 1MUSD protection on CAG is now having 500k on new CAG and 500k on LW. New CAG is indicated 20bps tighter while LW is 40bps wider. CAG is also a member of the investment grade credit indices in the US, the CDX.IG, in all series up to the latest the series 27. All credit indices members will also be split and will have 126 reference entities, CAG and LW being half weighted. This credit event is a source of large operations for credit derivatives trade processing in the next days.\n\nMeanwhile, the broader credit market went through a slow session with European investment grade risk being the weakest part of the investment spectrum.\n'

Definition of training, validation, and testing sets

From these blogs, we can extract (questions, answers), manually or with the help of a LLM.

Note that we won’t use the answers listed here to supervise the system, or evaluate the RAG answers. They are just there to satisfy curiosity.

questions_and_answers = [

{"question": "What business did Conagra Brands Inc. spin off on November 9, 2016?",

"answer": "Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business."},

{"question": "How much of Conagra's debt was transferred to Lamb Weston after the spin-off?",

"answer": "Half of Conagra’s debt was transferred to Lamb Weston."},

{"question": "What was the revenue size of the spun-off business, Lamb Weston?",

"answer": "Lamb Weston had revenues of $4 billion USD."},

{"question": "What were the credit ratings for Conagra and Lamb Weston after the spin-off?",

"answer": "After the spin-off, Conagra's credit rating was upgraded to BBB, and Lamb Weston's rating was BB."},

{"question": "According to the ISDA determination committee, how was the CDS protection split between Conagra and Lamb Weston?",

"answer": "A CDS holder who had $1 million USD protection on Conagra now has $500,000 on the new Conagra and $500,000 on Lamb Weston."},

{"question": "What false information was circulated about VINCI?",

"answer": "The false information claimed that VINCI had fired its finance chief amid irregularities and had discovered accounting errors."},

{"question": "What was the market reaction when the false news about VINCI was released?",

"answer": "The stock of VINCI plunged 18%, wiping more than €6 billion off its market capitalisation."},

{"question": "How did VINCI's stock recover after the false report?",

"answer": "The stock recovered most of its loss after the report was confirmed to be false."},

{"question": "What was the impact on VINCI's 5-year risk premium following the incident?",

"answer": "VINCI’s 5-year risk premium remained stable all day long, a couple of basis points tighter than the previous day's close at 58 bps."},

{"question": "What did QUIBB's management confirm during their call with analysts?",

"answer": "During their call with analysts, QUIBB's management stuck to their original plan regarding the rollout of the Burger King restaurants for 2017."},

{"question": "What details did Banca Monte dei Paschi provide about their debt for equity exchange?",

"answer": "anca Monte dei Paschi announced that they plan to offer equity worth between 85% and 100% of face value to the holders of their €4.3 billion outstanding subordinated bonds."},

{"question": "What is the total capital increase planned by Banca Monte dei Paschi before the end of the year?",

"answer": "Banca Monte dei Paschi has planned a total capital increase of €5 billion before the end of the year."},

{"question": "What is the intended purpose of the capital increase by Banca Monte dei Paschi?",

"answer": "The capital increase is instrumental in the process that should lead to the deconsolidation of their almost €28 billion portfolio of non-performing loans."},

{"question": "How did the market react to the confidence in the success of Banca Monte dei Paschi's deal?",

"answer": "Renewed confidence in the deal led investors to tighten MONTE’s 5-year risk premium by 12 bps to 392 bps, benefiting the whole Italian complex which outperformed other members of the European financial sector."},

{"question": "What specific event impacted the credit of Intrum Justitia and its competitor Lindorff AB?",

"answer": "ntrum Justitia, a Swedish debt collecting company, announced the acquisition of Lindorff AB, one of their Norwegian competitors. As a result, Lindorff’s debt will be refinanced, and CDS referencing LINDOR (Lock Lower Holding AS) will likely become orphaned."},

{"question": "What factors are crucial in the business of car rental according to the blog?",

"answer": "In the car rental business, maintaining a high utilization rate of the fleet and managing the sale of cars no longer wanted for customer use are crucial. Depreciation is highlighted as the highest cost in the industry."},

{"question": "What unexpected information did Hertz report about their third-quarter earnings?",

"answer": "Hertz reported third-quarter profits that badly trailed analysts’ estimates, attributing the shortfall to a decline in revenue and a drop in the values of its cars, which was unexpected and shocking to investors."},

{"question": "What are Hertz’s new forecasts for Ebitda, and what could be the potential impact on its leverage?",

"answer": "Hertz now forecasts an Ebitda of $575 million to $625 million for the year, which may push its leverage to more than 5 times by the end of the year. Moody’s indicated that such a leverage level could pressure Hertz's rating."},

{"question": "What is noted about the investment opportunities in distress credits?",

"answer": "Distress credits can offer a lot of convexity to investors, providing positive convexity for once, which suggests significant potential for gains as conditions improve."},

{"question": "What external factors have influenced the perception of AK Steel's stock?",

"answer": "The increase in iron ore prices by more than 50% this year, along with Donald Trump and Hillary Clinton's critical stance on China’s trade practices, have led equity investors to view AK Steel's stock as a call on the US steel recovery."},

{"question": "What financial move did AK Steel Holding Corporation recently make regarding its shares?",

"answer": "AK Steel Holding Corporation is issuing 52 million shares, which amounts to 25% of its market capitalization, to repay its outstanding borrowing under its asset-based revolver facility."},

{"question": "What decision did the ISDA Determination Committee make regarding NSINO's recent debt management action?",

"answer": "The ISDA Determination Committee decided on Friday, 22nd April, that NSINO’s action of extending bond maturities amounted to a restructuring credit event."},

{"question": "What options do investors who have bought protection on NSINO's CDS have following the ISDA's decision?",

"answer": "Investors who have bought protection on NSINO will have the opportunity to trigger their CDS contracts until the auction is held, though they are not obliged to do so."},

{"question": "What changes occurred to NSINO's position in credit indices following the ISDA's decision?",

"answer": "Following the ISDA's decision, NSINO has been spun off from all the credit indices to which it previously belonged."},

{"question": "How has the restructuring event affected an investor with a position in iTraxx Crossover Series 23 involving NSINO?",

"answer": "An investor (referred to as Investor X) who had a €74 million position in iTraxx Crossover Series 23 on Friday now has a €73 million position in the same series that no longer includes NSINO, along with a separate €1 million position on NSINO."},

{"question": "What sectors does NXP Semiconductors NV primarily supply chips for?",

"answer": "NXP Semiconductors is a leading chip supplier for smartphones and the auto industry, particularly after its acquisition of Freescale Semiconductor."},

{"question": "What are some of the applications of NXP's chips in the auto industry?",

"answer": "NXP's chips are used in a range of applications within the auto industry, including advanced driver assistance systems, infotainment, and in-vehicle networking between different car systems."},

{"question": "How did NXP's Q1 2016 earnings report compare to analysts' expectations?",

"answer": "NXP's Q1 2016 earnings report was in line with analysts' expectations, which surprised investors given the context."},

{"question": "What did NXP's management say about the demand and market conditions during their earnings report?",

"answer": "NXP's management mentioned that while overall demand continues to be subdued, the headwinds experienced last year should begin to subside in the coming quarter."},

{"question": "What was NXP's revenue and gross margin outlook for Q2, and how did it compare to the consensus estimates?",

"answer": "For Q2, NXP projected revenues of $2.3 to $2.4 billion and a gross margin of 49.5% to 50.5%, which was slightly ahead of the consensus estimates of $2.3 billion in revenue and a 49.8% gross margin."},

{"question": "What steps has Ball taken to win regulatory approval for its acquisition of Rexam?",

"answer": "To win regulatory approval, Ball announced that it had agreed with Rexam to sell plants in Brazil and Europe, along with innovation and support functions in Brazil, Britain, Germany, Switzerland, and the United States."},

{"question": "Who is acquiring the assets divested by Ball and Rexam, and what is the significance of this acquisition?",

"answer": "Ardagh Packaging (ARGID) is acquiring the divested assets, which is significant as it allows ARGID to acquire assets with combined revenues of around $3 billion."},

{"question": "Why did ARGID's risk premium not participate in the recent rally of the iTraxx Crossover index?",

"answer": "ARGID's risk premium did not rally with the iTraxx Crossover due to rumors that it was the leading bidder for the Ball-Rexam assets, which likely concerned investors about potential increased leverage."},

{"question": "How did the market react to the announcement regarding ARGID's involvement in the Ball-Rexam deal?",

"answer": "On the day of the announcement, investors marked ARGID’s 5-year CDS 36 basis points wider to 452 bps, reflecting concerns over the increased leverage from the acquisition."},

{"question": "What adjustments did Alcoa Inc make to its global aluminum demand forecast for 2016?",

"answer": "Alcoa Inc lowered its forecast for global aluminum demand in 2016, expecting a 5% increase, down from a previously projected 6% increase."},

{"question": "How did Alcoa Inc revise its market deficit projection for 2016?",

"answer": "Alcoa Inc decreased its market deficit projection for 2016 to a deficit of 1.1 million metric tons from 1.2 million metric tons estimated three months ago."},

{"question": "What significant financial move did ArcelorMittal SA announce?",

"answer": "ArcelorMittal SA announced they will buy back bonds after raising $3 billion earlier in the year through a rights issue. They plan to repurchase €1 billion of notes maturing in November 2017, €500 million due in March 2018, and $1.5 billion of securities maturing in June 2018."},

{"question": "At what levels did ArcelorMittal SA propose to buy back their bonds, and how was this received?",

"answer": "ArcelorMittal SA proposed to buy back their bonds at levels substantially above those at which they were trading in the secondary market, which puzzled some observers considering the already tight risk premia of the company."},

{"question": "How did investors react to ArcelorMittal's bond buyback announcement?",

"answer": "Investors reacted positively to the bond buyback announcement, sending the 5-year CDS of ArcelorMittal to its tightest level (584 bps) since the March roll."},

{"question": "Who owns and manages OTE (Hellenic Telecommunications Organisation SA)?",

"answer": "OTE is 40% owned and managed by Deutsche Telekom AG (DT) from Germany."},

{"question": "What event influenced investor sentiment positively despite OTE's earnings?",

"answer": "Investor sentiment was positively influenced by the Eurogroup meeting, where debt relief options for Greece were discussed earlier than expected."},

{"question": "How did the positive developments at the Eurogroup meeting affect OTE’s financial market indicators?",

"answer": "The positive tone at the Eurogroup meeting led to OTE’s 5-year risk premium tightening by 35 basis points to 431 bps."},

{"question": "What allegations are connected to the investigation surrounding Ohio House Bill 6?",

"answer": "The investigation involves accusations of bribery related to the passage of Ohio House Bill 6, with suggestions that illicit payments could have been as high as $60 million."},

{"question": "What were the consequences for FirstEnergy's leadership following the federal corruption scandal?",

"answer": "Following a board review triggered by the federal corruption scandal, FirstEnergy fired CEO Jones and other senior executives for violating the company’s policies and its code of conduct. Steven Strah was appointed as the acting CEO."},

{"question": "What financial operations were highlighted for FirstEnergy in 2019?",

"answer": "In 2019, FirstEnergy increased its cash reserves by approximately 60% or $250 million. It operationally generated over $2.47 billion, generated an additional $656 million from financing, and invested about $2.87 billion."},

{"question": "How did the market react to Novafives' third-quarter performance and outlook?",

"answer": "The company’s bonds were heavily punished, indicated approximately 6 points lower on the day, on top of already losing about 10 points since mid-November."},

{"question": "What specific issues did Novafives report in their third-quarter results?",

"answer": "Novafives reported weak third-quarter results with covenant net leverage increasing to 5.8 times, up from 4.8 in the second quarter."},

{"question": "What financial action did Vue International (VUECIN) take as December approaches?",

"answer": "Vue International decided to issue a 7-year facility, consisting of two tranches: one in euros amounting to roughly €600 million and one in GBP amounting to £300 million."},

{"question": "What are the intended uses of the proceeds from Vue International's new term loan?",

"answer": "The proceeds from the term loan will be used to finance the acquisition of Cinestar and its new site capital expenditures, as well as to refinance existing debt."},

{"question": "What will happen to VUECIN’s existing debt instruments as a result of the new term loan?",

"answer": "Vue International’s existing senior secured floating rate notes in euros and senior secured notes in sterling will be entirely taken out."},

{"question": "How will the new debt issuance affect the deliverables into VUECIN’s CDS contracts?",

"answer": "Following the issuance, only loans will be deliverable into CDS contracts going forward."},

{"question": "What was the impact on VUECIN’s leverage due to the new financing?",

"answer": "Despite the new financing, the leverage is expected to remain flat at 5.5x."},

{"question": "Why is BATSLN particularly vulnerable to the FDA’s potential regulation on menthol cigarettes?",

"answer": "BATSLN is particularly vulnerable because it produces Newport, the best-selling brand of menthol cigarettes in the US, and menthol cigarettes constitute about one-fourth of BATSLN's profits."},

{"question": "How did BATSLN's stock respond to the news of potential FDA restrictions on menthol cigarettes?",

"answer": "Following the announcement of potential FDA restrictions on menthol cigarettes, BATSLN’s stock price fell by 11%."},

{"question": "What other factor has contributed to the increased caution from investors towards BATSLN?",

"answer": "ncreased caution from investors towards BATSLN can also be attributed to the company’s higher leverage, now around 3.7x, which has persisted since the 2017 merger with Reynolds American Inc (RAI)."},

]

len(questions_and_answers)

55

questions = [dspy.Example(question=elem["question"]).with_inputs("question") for elem in questions_and_answers]

trainset = questions[:25]

devset = questions[25:35]

testset = questions[35:]

len(trainset), len(devset), len(testset)

(25, 10, 20)

Define the evaluation metric

An answer from the RAG system, produced by a language model, can be evaluated by another language model.

A RAG system may generate answers using a smaller faster model (to be reponsive for the user or just cost efficient).

However, if we need to evaluate the answers of the RAG system to benchmark or improve it, we can use a larger slower model.

This is what we are going to do next: The RAG system will be based on GPT 3.5 to generate answers; We will evaluate the quality of the answers using GPT 4.

# language model to generate answers

gpt_turbo = dspy.OpenAI(model="gpt-3.5-turbo", max_tokens=4000)

# language model to evaluate answers

metricLM = dspy.OpenAI(model='gpt-4', max_tokens=1000, model_type='chat')

class Assess(dspy.Signature):

"""Assess the quality of an answer to a question."""

context = dspy.InputField(desc="The context for answering the question.")

assessed_question = dspy.InputField(desc="The evaluation criterion.")

assessed_answer = dspy.InputField(desc="The answer to the question.")

assessment_answer = dspy.OutputField(desc="A rating between 1 and 5. Only output the rating and nothing else.")

def llm_metric(gold, pred, trace=None):

predicted_answer = pred.answer

question = gold.question

print(f"Test Question: {question}")

print(f"Predicted Answer: {predicted_answer}")

detail = "Is the assessed answer detailed?"

faithful = "Is the assessed text grounded in the context? Say no if it includes significant facts not in the context."

overall = f"Please rate how well this answer answers the question, `{question}` based on the context.\n `{predicted_answer}`"

with dspy.context(lm=metricLM):

context = retrieve(question)

detail = dspy.ChainOfThought(Assess)(context="N/A", assessed_question=detail, assessed_answer=predicted_answer)

faithful = dspy.ChainOfThought(Assess)(context=context, assessed_question=faithful, assessed_answer=predicted_answer)

overall = dspy.ChainOfThought(Assess)(context=context, assessed_question=overall, assessed_answer=predicted_answer)

print(f"Faithful: {faithful.assessment_answer}")

print(f"Detail: {detail.assessment_answer}")

print(f"Overall: {overall.assessment_answer}")

total = float(detail.assessment_answer) + float(faithful.assessment_answer)*2 + float(overall.assessment_answer)

return total / 5.0

test_example = dspy.Example(question="What do cross encoders do?")

test_pred = dspy.Example(answer="They re-rank documents.")

llm_metric(test_example, test_pred)

Test Question: What do cross encoders do?

Predicted Answer: They re-rank documents.

Faithful: 1

Detail: 1

Overall: 1

0.8

test_example = dspy.Example(question="What business did Conagra Brands Inc. spin off on November 9, 2016?")

test_pred = dspy.Example(answer="Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business.")

llm_metric(test_example, test_pred)

Test Question: What business did Conagra Brands Inc. spin off on November 9, 2016?

Predicted Answer: Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business.

Faithful: 5

Detail: 3

Overall: 5

3.6

Given (question, answer), we can inspect the calls (prompts) to the GPT 4 LLM, and the completions (green text), that are performed to evaluate the answer:

metricLM.inspect_history(n=3)

Assess the quality of an answer to a question.

---

Follow the following format.

Context: The context for answering the question.

Assessed Question: The evaluation criterion.

Assessed Answer: The answer to the question.

Reasoning: Let's think step by step in order to ${produce the assessment_answer}. We ...

Assessment Answer: A rating between 1 and 5. Only output the rating and nothing else.

---

Context: N/A

Assessed Question: Is the assessed answer detailed?

Assessed Answer: Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business.

Reasoning: Let's think step by step in order to[32m produce the assessment answer. We need to consider if the answer provides enough detail to fully answer the question. The answer does provide some detail, such as the company involved (Conagra), the action taken (spin-off), and the focus of the new company (frozen potato fries business). However, it does not provide any additional details such as the reason for the spin-off, the date it occurred, or the impact it had on either company.

Assessment Answer: 3[0m

Assess the quality of an answer to a question.

---

Follow the following format.

Context: The context for answering the question.

Assessed Question: The evaluation criterion.

Assessed Answer: The answer to the question.

Reasoning: Let's think step by step in order to ${produce the assessment_answer}. We ...

Assessment Answer: A rating between 1 and 5. Only output the rating and nothing else.

---

Context:

[1] «CAG ( Conagra Brands Inc. ) was a 12BUSD revenues food US company based in Chicago. On November 9, 2016, the company completed the spin-off of Lamb Weston - essentially its frozen potato fries business (a 4BUSD revenue business). French fries and any sort of fried potatoes is a sound investment. Half of the debt of Conagra was pushed to the new company LW (( Lamb Weston Holdings Inc. ). From a BBB- company, the new Conagra is now BBB while Lamb Weston is a BB. According to last Friday’s ISDA determination committee, a CDS holder having 1MUSD protection on CAG is now having 500k on new CAG and 500k on LW. New CAG is indicated 20bps tighter while LW is 40bps wider. CAG is also a member of the investment grade credit indices in the US, the CDX.IG, in all series up to the latest the series 27. All credit indices members will also be split and will have 126 reference entities, CAG and LW being half weighted. This credit event is a source of large operations for credit derivatives trade processing in the next days.

Meanwhile, the broader credit market went through a slow session with European investment grade risk being the weakest part of the investment spectrum.

»

[2] «Overnight 3G Capital Partners and Berkshire Hathaway have offered to merge Kraft Foods Group with HNZ (HJ Heinz Company) to create The Kraft Heinz Co. 3G and Berkshire will own 51% on the new company, while existing Kraft shareholders will get 49% and a $16.5 special dividend. Importantly for the CDS market, no new debt will be issued and the management announced that they are committed to maintaining an investment grade rating going forward. The operation is effectively removing the LBO risk which was overhanging on the food and beverage sector as 3G now appears committed (at least in the medium term). So entire complex traded better today, but the most spectacular move was seen in HNZ’s 5 year CDS which gapped 119bps to 64bps as investors expect it to be a dead box going forward.»

[3] «Back in March, METFNL ( Metro AG ) announced that it would proceed with a demerger, in order to separate its food business (Food Co) from its Consumer Electronics business (CE Co). METFNL held a conference call on the 6th September to give further details regarding the operation. All the financial liabilities of the group including bonds will be assumed by Food Co. Pension liabilities will be allocated 40% to Food Co and 60% to CE Co. Lease obligations will be 60% and 40%, and cash balances 75% and 25% respectively. Even though METFNL’s management expects both companies to maintain an investment grade rating after the spin-off, there won’t be any capital increase. That means that Food Co, due to the high debt load, will have at best weak credit metrics for its rating category and will be left with very limited financial leeway. Moody’s is understood to effectively ask the management to do more if Food Co is to be eligible for IG rating. That is probably why METFNL which will reference Food Co going forward has underperformed its peers during the last week.

Meanwhile, the broader credit market spent another day looking at US interest rates. It dithered all session, and was unable to decide whether to go wider or tighter. Credit indices traded in a range (328/335 for iTraxx Crossover and 69/72 for iTraxx Main) and eventually closed bang in the middle of it.

»

[4] «The failings of the food industry are in the spotlight again. This morning, ITV News and the Guardian have published a report that claims to have uncovered a series of safety breaches at the poultry plants of 2 Sisters Food Group (2SFG). The allegations involve tampering slaughter date of poultry being processed at sites that supply retailers including Tesco, Sainsbury’s, Marks & Spencer, Aldi and Lidl. The latters all said they would launch enquiries. Several of them decided to remove from their shelves products coming from the incriminated sites without further ado and have vowed to suspend their relationship with the firm until the investigation has concluded. 2SFG was founded in 1993 and now produces one third of all the poultry products consumed in the UK, and had revenues of £3.1Bln in 2016. Investors took the matter very seriously and parent company BOPRLN (Boparan Finance Plc) was under severe pressure as soon as the reports came out. Its 5-year risk premium jumped 169bps to 738bps. That is its widest level since it joined iTraxx Crossover 3 years ago.»

[5] «In an environment which has been supportive for credit over the last 12 months, a few names have been trading wider, especially in the Consumer Non-Cyclical sector. Releveraging seems to be on the agenda of a few companies through different channels. For instance, on the one hand, DGX ( Quest Diagnostics Inc) experienced weak trading conditions and decided to support its share price through share buy-backs. On the other hand, Campbell Soup (Campbell Soup Company) has been the subject of takeover speculations. Out of the money options on the stock experienced unusually high volumes recently and 5 year protection has been pushed aggressively wider. LBO could be back in people’s mind if they think systemic risks are receding.»

Assessed Question: Is the assessed text grounded in the context? Say no if it includes significant facts not in the context.

Assessed Answer: Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business.

Reasoning: Let's think step by step in order to[32m produce the assessment answer. We can see that the assessed answer is indeed grounded in the context. The first paragraph of the context mentions that Conagra completed the spin-off of Lamb Weston, which is its frozen potato fries business. Therefore, the assessed answer is accurate and does not include any significant facts not in the context.

Assessment Answer: 5[0m

Assess the quality of an answer to a question.

---

Follow the following format.

Context: The context for answering the question.

Assessed Question: The evaluation criterion.

Assessed Answer: The answer to the question.

Reasoning: Let's think step by step in order to ${produce the assessment_answer}. We ...

Assessment Answer: A rating between 1 and 5. Only output the rating and nothing else.

---

Context:

[1] «CAG ( Conagra Brands Inc. ) was a 12BUSD revenues food US company based in Chicago. On November 9, 2016, the company completed the spin-off of Lamb Weston - essentially its frozen potato fries business (a 4BUSD revenue business). French fries and any sort of fried potatoes is a sound investment. Half of the debt of Conagra was pushed to the new company LW (( Lamb Weston Holdings Inc. ). From a BBB- company, the new Conagra is now BBB while Lamb Weston is a BB. According to last Friday’s ISDA determination committee, a CDS holder having 1MUSD protection on CAG is now having 500k on new CAG and 500k on LW. New CAG is indicated 20bps tighter while LW is 40bps wider. CAG is also a member of the investment grade credit indices in the US, the CDX.IG, in all series up to the latest the series 27. All credit indices members will also be split and will have 126 reference entities, CAG and LW being half weighted. This credit event is a source of large operations for credit derivatives trade processing in the next days.

Meanwhile, the broader credit market went through a slow session with European investment grade risk being the weakest part of the investment spectrum.

»

[2] «Overnight 3G Capital Partners and Berkshire Hathaway have offered to merge Kraft Foods Group with HNZ (HJ Heinz Company) to create The Kraft Heinz Co. 3G and Berkshire will own 51% on the new company, while existing Kraft shareholders will get 49% and a $16.5 special dividend. Importantly for the CDS market, no new debt will be issued and the management announced that they are committed to maintaining an investment grade rating going forward. The operation is effectively removing the LBO risk which was overhanging on the food and beverage sector as 3G now appears committed (at least in the medium term). So entire complex traded better today, but the most spectacular move was seen in HNZ’s 5 year CDS which gapped 119bps to 64bps as investors expect it to be a dead box going forward.»

[3] «Back in March, METFNL ( Metro AG ) announced that it would proceed with a demerger, in order to separate its food business (Food Co) from its Consumer Electronics business (CE Co). METFNL held a conference call on the 6th September to give further details regarding the operation. All the financial liabilities of the group including bonds will be assumed by Food Co. Pension liabilities will be allocated 40% to Food Co and 60% to CE Co. Lease obligations will be 60% and 40%, and cash balances 75% and 25% respectively. Even though METFNL’s management expects both companies to maintain an investment grade rating after the spin-off, there won’t be any capital increase. That means that Food Co, due to the high debt load, will have at best weak credit metrics for its rating category and will be left with very limited financial leeway. Moody’s is understood to effectively ask the management to do more if Food Co is to be eligible for IG rating. That is probably why METFNL which will reference Food Co going forward has underperformed its peers during the last week.

Meanwhile, the broader credit market spent another day looking at US interest rates. It dithered all session, and was unable to decide whether to go wider or tighter. Credit indices traded in a range (328/335 for iTraxx Crossover and 69/72 for iTraxx Main) and eventually closed bang in the middle of it.

»

[4] «The failings of the food industry are in the spotlight again. This morning, ITV News and the Guardian have published a report that claims to have uncovered a series of safety breaches at the poultry plants of 2 Sisters Food Group (2SFG). The allegations involve tampering slaughter date of poultry being processed at sites that supply retailers including Tesco, Sainsbury’s, Marks & Spencer, Aldi and Lidl. The latters all said they would launch enquiries. Several of them decided to remove from their shelves products coming from the incriminated sites without further ado and have vowed to suspend their relationship with the firm until the investigation has concluded. 2SFG was founded in 1993 and now produces one third of all the poultry products consumed in the UK, and had revenues of £3.1Bln in 2016. Investors took the matter very seriously and parent company BOPRLN (Boparan Finance Plc) was under severe pressure as soon as the reports came out. Its 5-year risk premium jumped 169bps to 738bps. That is its widest level since it joined iTraxx Crossover 3 years ago.»

[5] «In an environment which has been supportive for credit over the last 12 months, a few names have been trading wider, especially in the Consumer Non-Cyclical sector. Releveraging seems to be on the agenda of a few companies through different channels. For instance, on the one hand, DGX ( Quest Diagnostics Inc) experienced weak trading conditions and decided to support its share price through share buy-backs. On the other hand, Campbell Soup (Campbell Soup Company) has been the subject of takeover speculations. Out of the money options on the stock experienced unusually high volumes recently and 5 year protection has been pushed aggressively wider. LBO could be back in people’s mind if they think systemic risks are receding.»

Assessed Question: Please rate how well this answer answers the question, `What business did Conagra Brands Inc. spin off on November 9, 2016?` based on the context. `Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business.`

Assessed Answer: Conagra completed the spin-off of Lamb Weston, which is primarily focused on the frozen potato fries business.

Reasoning: Let's think step by step in order to[32m produce the assessment answer. We first look at the context provided. The first paragraph clearly states that Conagra Brands Inc. completed the spin-off of Lamb Weston, which is essentially its frozen potato fries business. This directly answers the question asked. The assessed answer is accurate and directly taken from the context, providing the exact information asked for in the question.

Assessment Answer: 5[0m

Generation ‘module’

class GenerateAnswer(dspy.Signature):

"""Answer questions based on the context."""

context = dspy.InputField(desc="may contain relevant facts")

question = dspy.InputField()

answer = dspy.OutputField()

# setting GPT 3.5 as the default lm for the generation in dspy

dspy.settings.configure(lm=gpt_turbo)

# dummy example of the og tutorial, with a code fix on the missing context

dspy.Predict(GenerateAnswer)(question="What are Cross Encoders?", context="Not available.")

dspy.settings.lm.inspect_history(n=1)

Answer questions based on the context.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Answer: ${answer}

---

Context: Not available.

Question: What are Cross Encoders?

Answer: Cross Encoders are a type of neural network architecture used in natural language processing tasks, particularly in sentence pair classification. They take two input sequences and produce a single output, making them suitable for tasks like semantic textual similarity and paraphrase identification.[0m

# same, but with an extra CoT step

dspy.ChainOfThought(GenerateAnswer)(question="What are Cross Encoders?", context="Not available.")

dspy.settings.lm.inspect_history(n=1)

Answer questions based on the context.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Reasoning: Let's think step by step in order to ${produce the answer}. We ...

Answer: ${answer}

---

Context: Not available.

Question: What are Cross Encoders?

Reasoning: Let's think step by step in order to[32m understand what Cross Encoders are. Cross Encoders are a type of neural network architecture commonly used in natural language processing tasks. They are designed to take two input sequences and produce a single output, typically used for tasks like sentence pair classification or similarity scoring.

Answer: Cross Encoders are a type of neural network architecture used in NLP tasks to process two input sequences and produce a single output.[0m

Definition of the RAG system: Retriever + Generation modules

class RAG(dspy.Module):

def __init__(self, num_passages=3):

super().__init__()

self.retrieve = retrieve

self.generate_answer = dspy.ChainOfThought(GenerateAnswer)

def forward(self, question):

context = self.retrieve(question)

prediction = self.generate_answer(context=context, question=question)

return dspy.Prediction(answer=prediction.answer)

uncompiled_rag = RAG()

Here is an example of a question that cannot be answered by strictly adhering to the given corpus (and retrieved context):

print(uncompiled_rag("What are re-rankers in search engines?").answer)

The context provided does not mention re-rankers in search engines. Therefore, we cannot provide an answer to this question based on the given information.

dspy.settings.lm.inspect_history(n=1)

Answer questions based on the context.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Reasoning: Let's think step by step in order to ${produce the answer}. We ...

Answer: ${answer}

---

Context:

[1] «The session turned out to be fairly strong across the board, and there were only a handful of names which closed wider on the day. The tone was a bit more hesitant in the morning though, as people feared that the bank holiday in the US tomorrow would weight on liquidity. In the early hours of trading, RENAUL ( Renault SA ) was one of the standout names. It started the day strongly on the back of an upgrade by Fitch. The rating agency revised RENAUL’s rating to BBB- outlook positive, bringing it back in the investment grade category. The 5 year CDS quickly tightened by 15bps (it closed at 112.5bps) as buyers of cash started to emerge. Indeed, if this upgrade took place earlier that investors had anticipated, they now expect S&P; and Moodys to follow suit. If that happens, investment grade funds will start to buy cash, which should lead to further outperformance. Rating actions still matter, especially for names that sit on the border of investment grade and high yield. »

[2] «European synthetic credit market added in March 11 new high yield reference entities to its trading catalog. The new names represent 11 out of the 12 additions to the new series of the European Crossover index.

The last one addition is a fallen angel (TDC A/S). After a month,

the roll was march the 20th, the trading of these new names is still rather subdued and a sort

of disappointment for market participants. It is hard to assess the true activity.

The tip of the Iceberg is the reported cleared volume by LCH CDSCLear,

the only CDS clearing house offering to clear these new names.

Out of the 11 names, WIND TRE S.P.A. and Verisure Midholding AB are the only one with reported

open interests as of yesterday according to OTCStreaming.

Some of the new names are well known special situations in the European high yield community.

These entities have large bond issues like Picard Bondco S.A. with a 1.2BEuros 5Y FRN

issued late last year. But the derivatives community is not familiar with these names

especially due to the lack of time series. DataGrapple infers for these entities an

alleged time series using the "best" benchmark. The choice of the benchmark is not obvious.

In some situation a benchmark is not relevant. For STEINHOFF EUROPE AG, Datagrapple team decided

to use NEW LOOK SENIOR ISSUER PLC as the best proxy to backward infer a time series (see the attached

the grapple). DataGrapple provides estimates for all the new CDS entities, hopefully it helps to make some rough estimate of their risks.»

[3] «When the composition of the Crossover is modified, the common belief is that new entrants will suffer as they are now part of the hedging tool most widely used by portfolio managers, and that names existing the index will benefit. This Grapple paints a slightly different picture, and shows that this time around, if the exiting names are among the best performers since the beginning of the week, the new entrants are also part of this elite group. Dealers might have been a bit harsh on them on Monday anticipating high demand for protection, and these high risk premia triggered some clients’ selling of CDS. The hunt for yield is still on, and some of the names joining the index have decent credit metrics which makes them interesting portfolio diversifying options.»

[4] «The roll and the launch of the new series of indices have not brought a sea of change to the credit market. On the one hand, credit indices remain an investment vehicle of choice and most index rolls between new series and the previous ones trade below their fair value (with the exception of iTraxx Financials in Europe where clients are still short risk). This means that new series are more expensive (i.e. they trade tighter relative to their values) than the previous ones. On the other hand, there are numerous stories affecting single names. The commodities’ saga is still unfolding, Emerging Markets are a concern to investors, and the automotive sector is having a brutal time (particularly in Europe) to name a few. So one should not be surprised to see the negative index credit bases environment persist for some time.»

[5] «You might struggle to see all of them on this grapple, but we are pleased to announce that the universe captured by DataGrapple has now been slightly expanded: the number of entities on which prices and volumes are available has increased from 680 to 697, mainly on the back on new inclusions in the indices launched last Friday (we also slightly anticipated the launch of CDXHY series 24). In addition to the index constituents, DataGrapple still references the 500 most actively traded reference entities over the last 6 months according to DTTC. Rating changes have been factored in, and the relevant trees now reflect this of course. We also put a great amount of work on improving our clustering algorithm. Based on our 9-year-long time series, it produces all the Machine Trees which regroup statistically close entities. They should be much more stable going forward. As always comments and questions are welcome, so please get in touch with us.»

Question: What are re-rankers in search engines?

Reasoning: Let's think step by step in order to[32m produce the answer. We need to understand the context provided and look for any mention of re-rankers in search engines.

Answer: The context provided does not mention re-rankers in search engines. Therefore, we cannot provide an answer to this question based on the given information.[0m

Here is an example of a question that can be answered using the provided blogs:

print(uncompiled_rag("What is the intended purpose of the capital increase by Banca Monte dei Paschi?").answer)

The intended purpose of the capital increase by Banca Monte dei Paschi is to strengthen the bank's financial position and address its bad loan portfolio by deconsolidating almost €28 billion in non-performing loans.

dspy.settings.lm.inspect_history(n=1)

Answer questions based on the context.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Reasoning: Let's think step by step in order to ${produce the answer}. We ...

Answer: ${answer}

---

Context:

[1] «Over the last fortnight, MONTE’s ( Banca Monte dei Paschi ) stock has roughly doubled. The 5-year risk premium of its senior debt has been cut by 125bps to 350bps since late September. This morning, it looked as if this amazing ride could continue for a while. The company outlined plans to eliminate 2,600 jobs, shut 500 branches and slash the lender's €28Bln pile of bad loans. That sent the stock another 20% up and the debt risk premium another 20bps tighter. To complete its turnaround, the bank also needs to raise €5Bln in fresh capital by year end though, and the CEO admitted that his effort had only begun in that respect. The plan involves a voluntary debt to equity swap, in order to cut the amount MONTE would need to raise from shareholders. The bank wants to spin off €28Bln of souring loan, swap debt for equity and manage a capital increase all at the same time in an exceptionally compressed timeframe. To make things trickier still, there is the December 4 constitutional referendum in Italy which could lead to a increased volatility towards the end of the year. When that reality hit investors, they sent the stock 30% down from its - 15% down on the day -and the risk premium back to almost unchanged on the day.

»

[2] «Once the results of the Italian referendum were known, MONTE’s ( Banca Monte dei Paschi ) board asked to the ECB an extension from the end of the year to Jan. 20 of the deadline set for its recapitalisation exercise “due to the changed reference context”. A delay would have allowed the bank more time to find investors while Italian leaders put a new government in place following the resignation of Prime Minister Matteo Renzi. Early in the afternoon, it emerged that the ECB rejected the bank’s request, increasing the likelihood of a state bailout that would impose losses on shareholders and bondholders. Up to that point, the credit market had been back on the bullish trajectory it has followed since Monday. If the news was not enough to derail the whole market (iTraxx Main closed 1.5bps at 72.5bps and iTraxx Crossover 8bps tighter at 306.5bps), it reversed the trend of iTraxx Financial Senior and Subordinated which closed 1bps wider at 98bps (2bps off the intraday tights) and 3.5bps wider at 225.5bps (12bps off the intraday tights) respectively. On Monday, we might learn how systemically important MONTE really is…»

[3] «Italian banks have been much talked about over the last few sessions. Positive vibes first came during the week-end when Banca Popolare Di Milano and BPIM ( Banca Popolare SC ) won shareholders’ approval for a merger creating Italy’s third largest lender. Today, MONTE’s ( Banca Monte dei Paschi ) board met after asking their CEO to look into a proposal by Mr Passera, Italy’s ex-minister for economic development and former CEO of Intesa Sanpaolo, to shore up its finances. The plan envisions a €5Bln capital increase, which would include a €1Bln share sale to existing shareholders and €2.5Bln from new long terms backers. While volumes traded on peripheral banks are still dwarfed by transactions on DB, these string of positive news enabled them to outperformed their peers recently and they are the brightest green spots in the above grapple.

Meanwhile, the broader credit market also benefitted from the better tone in the financial sector and from a few earnings beats which buoyed the equity market. Until tomorrow night, iTraxx Main and CDXIG could find it difficult to trade significantly away from their current levels (72.5bps and 75bps respectively) as these are important pins for options expiring late in the afternoon.

»

[4] «MONTE ( Banca Monte dei Paschi ) gave some details about their debt for equity exchange yesterday night. They plan to offer equity worth between 85% and 100% of face value to the holders of their €4.3Bln outstanding subordinated bonds. The generous terms reflect the need to deliver on this transaction as fully as possible. Indeed, they want to keep the amount of fresh external equity to be raised to a minimum, as the €5Bln total capital increase planned before the end of the year is instrumental in a process that should lead to the deconsolidation of their almost €28Bln portfolio of non-performing loans. Renewed confidence in the success of the deal led investors to send MONTE’s 5-year risk premium 12bps tighter to 392bps, and benefitted the whole Italian complex which outperformed other members of the European financial sector.

Meanwhile, the broader credit market benefitted from the stabilisation of interest rates in Europe and in the US which held onto their overnight (modest) gains throughout the session. iTraxx Crossover and CDX High Yield were the outperformers (closing 9bps and 16bps tighter at 341bps and 418bps respectively), while iTraxx Main (ITXEB) and CDX IG closed 1.5bps and 3bps tighter at 77.5bps and 75bps respectively. Tomorrow is option expiry day on credit indices, and chances are that ITXEB will be attracted by the 75bps strike which represents an important option pin.

»

[5] «On Friday, it emerged that Fortress Investment Group and Elliott Capital Management had dropped out of talks to buy bad loans from MONTE ( Banca Monte dei Paschi ) complicating the rescue plan for the lender backed by the Italian government. They were the only international bidders for the riskier tranches of MONTE’s bad loan securitization. That leaves Atlante, the fund set up to help the struggling Italian banking sector, as the only potential buyer and jeopardizes the asset sale, which is a key part of the plan to restructure the bank with a capital injection from the state, after MONTE failed to shore up capital privately. Ultimately, it could also make similar rescue plans for two other northern Italian lenders, Veneto Banca Spa and Popolare Vicenza Spa, much more difficult to pull off. Surprisingly, if MONTE’s 5-year risk premium was marked aggressively wider - insuring senior debt now costs 330bps per year, while insuring subordinated costs 73.5% upfront -, it did not feed through the whole Italian banking sector and most names were actually unchanged to a tad tighter.»

Question: What is the intended purpose of the capital increase by Banca Monte dei Paschi?

Reasoning: Let's think step by step in order to[32m produce the answer. We know from the context that Banca Monte dei Paschi plans to raise €5 billion in fresh capital by the end of the year. This capital increase is instrumental in a process that should lead to the deconsolidation of their almost €28 billion portfolio of non-performing loans. The bank also plans to offer equity to holders of their outstanding subordinated bonds as part of a debt-to-equity exchange. Therefore, the intended purpose of the capital increase is to strengthen the bank's financial position and address its bad loan portfolio.

Answer: The intended purpose of the capital increase by Banca Monte dei Paschi is to strengthen the bank's financial position and address its bad loan portfolio by deconsolidating almost €28 billion in non-performing loans.[0m

We can evaluate this crude RAG (un-optimized prompts) on the (validation) devset, and obtain a baseline score:

from dspy.evaluate.evaluate import Evaluate

evaluate = Evaluate(devset=devset, num_threads=1, display_progress=True, display_table=5)

evaluate(RAG(), metric=llm_metric)

0%| | 0/10 [00:00<?, ?it/s]

Test Question: What sectors does NXP Semiconductors NV primarily supply chips for?

Predicted Answer: NXP Semiconductors NV primarily supplies chips for the smartphone and auto industries.

Faithful: 5

Average Metric: 3.4 / 1 (340.0): 10%|█ | 1/10 [00:00<00:03, 2.35it/s]

Detail: 2

Overall: 5

Test Question: What are some of the applications of NXP's chips in the auto industry?

Predicted Answer: Some of the applications of NXP's chips in the auto industry include advanced driver assistance systems, "infotainment," and in-vehicle networking between different car systems.

Average Metric: 7.4 / 2 (370.0): 20%|██ | 2/10 [00:00<00:03, 2.16it/s]

Faithful: 5

Detail: 5

Overall: 5

Test Question: How did NXP's Q1 2016 earnings report compare to analysts' expectations?

Predicted Answer: NXP's Q1 2016 earnings report was in line with analysts' expectations, and the company managed to surprise investors with their numbers.

Average Metric: 11.0 / 3 (366.7): 30%|███ | 3/10 [00:01<00:03, 2.25it/s]

Faithful: 5

Detail: 3

Overall: 5

Test Question: What did NXP's management say about the demand and market conditions during their earnings report?

Predicted Answer: The management of NXP stated that overall demand continues to be subdued, but they also mentioned that the headwinds experienced in the previous year should begin to subside in the coming quarter.

Average Metric: 15.0 / 4 (375.0): 40%|████ | 4/10 [00:01<00:02, 2.12it/s]

Faithful: 5

Detail: 5

Overall: 5

Test Question: What was NXP's revenue and gross margin outlook for Q2, and how did it compare to the consensus estimates?

Predicted Answer: The revenue outlook for Q2 was $2.3-2.4 billion, slightly above the consensus of $2.3 billion, and the gross margin outlook was 49.5-50.5%, slightly above the consensus of 49.8%.

Average Metric: 19.0 / 5 (380.0): 50%|█████ | 5/10 [00:02<00:02, 2.15it/s]

Faithful: 5

Detail: 5

Overall: 5

Test Question: What steps has Ball taken to win regulatory approval for its acquisition of Rexam?

Predicted Answer: Ball has agreed with Rexam to sell plants in Brazil and Europe, along with innovation and support functions in several countries, to ARGID (Ardagh Packaging) to satisfy regulatory concerns. This divestment program is subject to regulatory approvals and will enable ARGID to acquire assets with combined revenues of around $3 billion. Additionally, ARGID will issue $2.85 billion of secured and unsecured notes to help finance the operation.

Average Metric: 23.0 / 6 (383.3): 60%|██████ | 6/10 [00:02<00:01, 2.06it/s]

Faithful: 5

Detail: 5

Overall: 5

Test Question: Who is acquiring the assets divested by Ball and Rexam, and what is the significance of this acquisition?

Predicted Answer: ARGID (Ardagh Packaging) is acquiring the assets divested by Ball and Rexam. This acquisition is significant as it will allow ARGID to acquire assets with combined revenues of around $3 billion, costing the company approximately $3.4 billion, as part of a divestment program to satisfy regulatory concerns related to the Ball-Rexam deal.

Average Metric: 27.0 / 7 (385.7): 70%|███████ | 7/10 [00:03<00:01, 1.98it/s]

Faithful: 5

Detail: 5

Overall: 5

Test Question: Why did ARGID's risk premium not participate in the recent rally of the iTraxx Crossover index?

Predicted Answer: ARGID's risk premium did not participate in the recent rally of the iTraxx Crossover index because it has been dropped from the index and is no longer included in the group of entities being traded.

Average Metric: 27.0 / 8 (337.5): 80%|████████ | 8/10 [00:04<00:01, 1.74it/s]

Faithful: No

Detail: 5

Overall: 1

Error for example in dev set: could not convert string to float: 'No'

Test Question: How did the market react to the announcement regarding ARGID's involvement in the Ball-Rexam deal?

Predicted Answer: The market reacted to the announcement regarding ARGID's involvement in the Ball-Rexam deal by marking ARGID's 5-year CDS 36bps wider to 452bps.

Average Metric: 31.0 / 9 (344.4): 90%|█████████ | 9/10 [00:04<00:00, 1.77it/s]

Faithful: 5

Detail: 5

Overall: 5

Test Question: What adjustments did Alcoa Inc make to its global aluminum demand forecast for 2016?

Predicted Answer: Alcoa Inc adjusted their global aluminum demand forecast for 2016 from a 6% increase to a 5% climb.

Average Metric: 34.8 / 10 (348.0): 100%|██████████| 10/10 [00:05<00:00, 1.90it/s]

Faithful: 5

Detail: 4

Overall: 5

Average Metric: 34.8 / 10 (348.0%)

| question | answer | llm_metric | |

|---|---|---|---|

| 0 | What sectors does NXP Semiconductors NV primarily supply chips for? | NXP Semiconductors NV primarily supplies chips for the smartphone and auto industries. | 3.4 |

| 1 | What are some of the applications of NXP's chips in the auto industry? | Some of the applications of NXP's chips in the auto industry include advanced driver assistance systems, "infotainment," and in-vehicle networking between different car systems. | 4.0 |

| 2 | How did NXP's Q1 2016 earnings report compare to analysts' expectations? | NXP's Q1 2016 earnings report was in line with analysts' expectations, and the company managed to surprise investors with their numbers. | 3.6 |

| 3 | What did NXP's management say about the demand and market conditions during their earnings report? | The management of NXP stated that overall demand continues to be subdued, but they also mentioned that the headwinds experienced in the previous year should... | 4.0 |

| 4 | What was NXP's revenue and gross margin outlook for Q2, and how did it compare to the consensus estimates? | The revenue outlook for Q2 was $2.3-2.4 billion, slightly above the consensus of $2.3 billion, and the gross margin outlook was 49.5-50.5%, slightly above the... | 4.0 |

348.0

Using DSPy to optimize the RAG system with BootstrapFewShot

from dspy.teleprompt import BootstrapFewShot

teleprompter = BootstrapFewShot(metric=llm_metric, max_labeled_demos=8, max_rounds=3)

compiled_rag = teleprompter.compile(uncompiled_rag, trainset=trainset)

0%| | 0/25 [00:00<?, ?it/s]

Test Question: What business did Conagra Brands Inc. spin off on November 9, 2016?

Predicted Answer: Conagra Brands Inc. spun off Lamb Weston on November 9, 2016.

4%|▍ | 1/25 [00:00<00:09, 2.52it/s]

Faithful: 5

Detail: 5

Overall: 5

8%|▊ | 2/25 [00:00<00:09, 2.52it/s]

Test Question: How much of Conagra's debt was transferred to Lamb Weston after the spin-off?

Predicted Answer: Half of Conagra's debt was transferred to Lamb Weston after the spin-off.

Faithful: 5

Detail: 3

Overall: 5

Test Question: What was the revenue size of the spun-off business, Lamb Weston?

Predicted Answer: The revenue size of the spun-off business, Lamb Weston, was 4 billion USD.

12%|█▏ | 3/25 [00:01<00:09, 2.42it/s]

Faithful: 5

Detail: 2

Overall: 5

Test Question: What were the credit ratings for Conagra and Lamb Weston after the spin-off?

Predicted Answer: Conagra's credit rating after the spin-off was BBB, and Lamb Weston's credit rating was BB.

16%|█▌ | 4/25 [00:01<00:09, 2.32it/s]

Faithful: 5

Detail: 5

Overall: 5

0%| | 0/25 [00:00<?, ?it/s]

0%| | 0/25 [00:00<?, ?it/s]

Bootstrapped 4 full traces after 1 examples in round 2.

compiled_rag("What is the intended purpose of the capital increase by Banca Monte dei Paschi?").answer

'The intended purpose of the capital increase by Banca Monte dei Paschi is to lead to the deconsolidation of their almost €28 billion portfolio of non-performing loans.'

If we inspect the LLM call, we can observe that the prompt is now much longer and contains several examples of (context, question, reasoning, answer) before the completion of the actual expected answer:

dspy.settings.lm.inspect_history(n=1)

Answer questions based on the context.

---

Follow the following format.

Context: may contain relevant facts

Question: ${question}

Reasoning: Let's think step by step in order to ${produce the answer}. We ...

Answer: ${answer}

---

Context:

[1] «CAG ( Conagra Brands Inc. ) was a 12BUSD revenues food US company based in Chicago. On November 9, 2016, the company completed the spin-off of Lamb Weston - essentially its frozen potato fries business (a 4BUSD revenue business). French fries and any sort of fried potatoes is a sound investment. Half of the debt of Conagra was pushed to the new company LW (( Lamb Weston Holdings Inc. ). From a BBB- company, the new Conagra is now BBB while Lamb Weston is a BB. According to last Friday’s ISDA determination committee, a CDS holder having 1MUSD protection on CAG is now having 500k on new CAG and 500k on LW. New CAG is indicated 20bps tighter while LW is 40bps wider. CAG is also a member of the investment grade credit indices in the US, the CDX.IG, in all series up to the latest the series 27. All credit indices members will also be split and will have 126 reference entities, CAG and LW being half weighted. This credit event is a source of large operations for credit derivatives trade processing in the next days.

Meanwhile, the broader credit market went through a slow session with European investment grade risk being the weakest part of the investment spectrum.

»

[2] «Overnight 3G Capital Partners and Berkshire Hathaway have offered to merge Kraft Foods Group with HNZ (HJ Heinz Company) to create The Kraft Heinz Co. 3G and Berkshire will own 51% on the new company, while existing Kraft shareholders will get 49% and a $16.5 special dividend. Importantly for the CDS market, no new debt will be issued and the management announced that they are committed to maintaining an investment grade rating going forward. The operation is effectively removing the LBO risk which was overhanging on the food and beverage sector as 3G now appears committed (at least in the medium term). So entire complex traded better today, but the most spectacular move was seen in HNZ’s 5 year CDS which gapped 119bps to 64bps as investors expect it to be a dead box going forward.»

[3] «Back in March, METFNL ( Metro AG ) announced that it would proceed with a demerger, in order to separate its food business (Food Co) from its Consumer Electronics business (CE Co). METFNL held a conference call on the 6th September to give further details regarding the operation. All the financial liabilities of the group including bonds will be assumed by Food Co. Pension liabilities will be allocated 40% to Food Co and 60% to CE Co. Lease obligations will be 60% and 40%, and cash balances 75% and 25% respectively. Even though METFNL’s management expects both companies to maintain an investment grade rating after the spin-off, there won’t be any capital increase. That means that Food Co, due to the high debt load, will have at best weak credit metrics for its rating category and will be left with very limited financial leeway. Moody’s is understood to effectively ask the management to do more if Food Co is to be eligible for IG rating. That is probably why METFNL which will reference Food Co going forward has underperformed its peers during the last week.

Meanwhile, the broader credit market spent another day looking at US interest rates. It dithered all session, and was unable to decide whether to go wider or tighter. Credit indices traded in a range (328/335 for iTraxx Crossover and 69/72 for iTraxx Main) and eventually closed bang in the middle of it.

»